Decoding Wall Street with best-in-class sentiment analysis

When it comes to event-driven research, sentiment analysis is crucial for efficiently interpreting vast amounts of textual data.

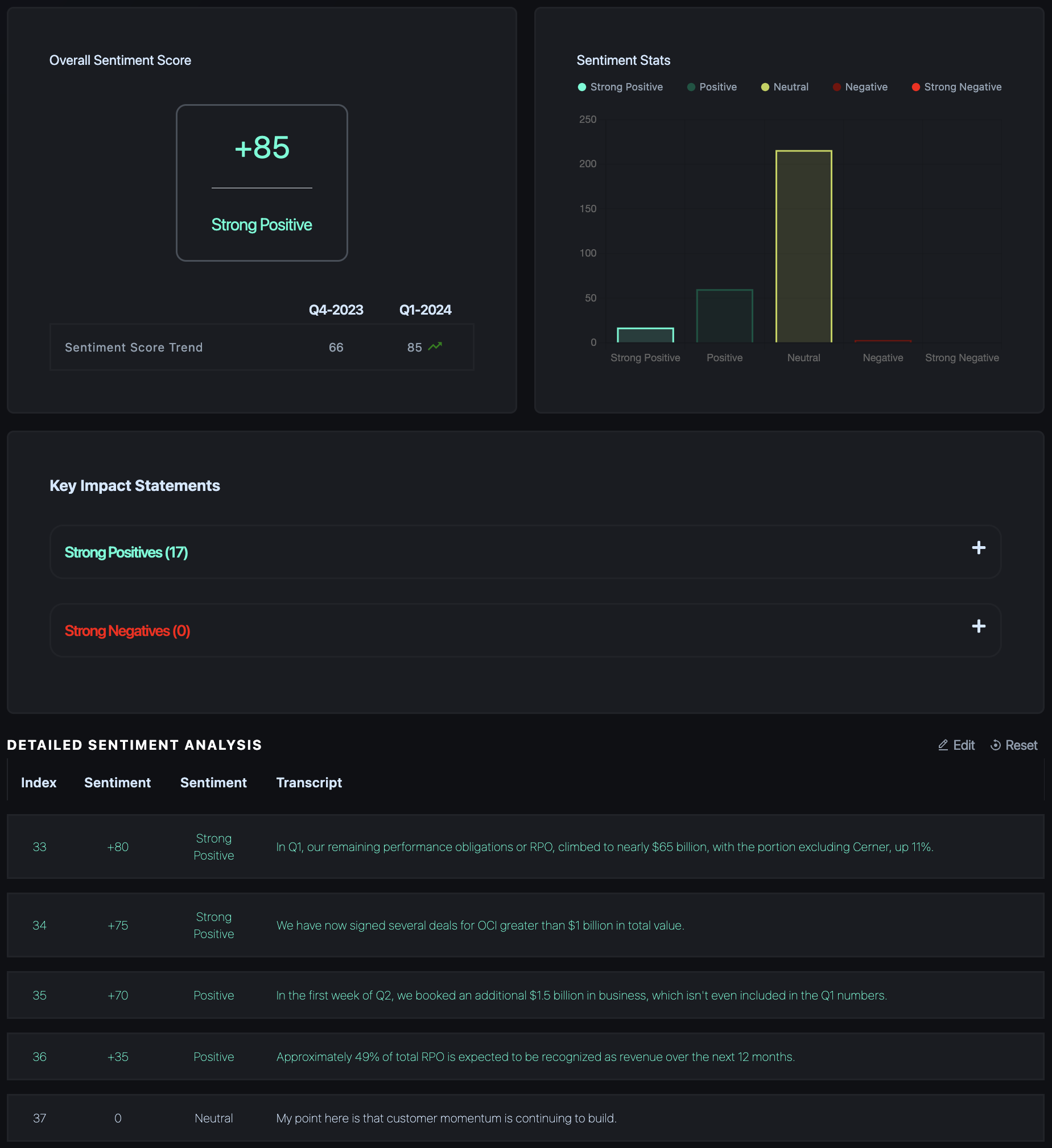

We leverage GPT-4 to overcome intrinsic challenges in conventional sentiment analysis methods. Our innovative approach to sentiment analysis is designed to appreciate the broader context of each individual statement, yielding a more comprehensive and precise sentiment profile. We utilize a bottom-up strategy, where each statement is ranked individually and then aggregated into consolidated metrics for snapshot insights.

- Algorithmic sentiment scoring ranks each statement according to its impact on the company's future expected performance.

- Individual statement scores converge to form our overall sentiment metrics – offering rapid, intelligible insights from the target event.

- Key impact statements are extracted to pinpoint pivotal topics that have the greatest influence on future performance.

Customizable to your unique investment preferences.

Our sentiment analysis is completely customizable, allowing users to modify any default scoring from our model to better suit individual investment styles, perspectives, and risk tolerance. Recognizing that every investor is unique, we offer the flexibility to adjust individual statement scores to align more closely with user perspectives. Any alterations are seamlessly integrated and reflected across our entire suite of sentiment analysis tools.

Best-in-class sentiment analysis AI model

Extract critical insights from textual information to enhance analysis workflows.

- Calibrated for Industry Specific Verbiage.

- Our model is calibrated to understand and interpret industry-specific language, ensuring accurate and relevant insights that enhance decision-making across complex market environments.

- Gradient Scoring System.

- Our model employs a gradient scoring system ranging from +100 to -100, offering a more refined sentiment assessment compared to conventional binary models and a truer representation of prevailing sentiments.

- Key Impact Statement Spotlight.

- Our model extracts pivotal statements, enabling users to swiftly pinpoint and concentrate on the information that has the greatest impact on future expected performance.

- User Editable Scores.

- Empowering users to modify default sentiment scores providing more personalized and pertinent insights that align with individual requirements and preferences.

- Advanced Pattern Recognition.

- Our model adeptly detects and tracks sentiment patterns, proactively alerting you to rising or deteriorating sentiment trends.

- Proactive Portfolio Monitoring.

- Our model acts as a leading indicator, proactively identifying valuable buying opportunites while protecting investors from impending downside risks.